Uniswap v4 Returns Update: Patience Pays Off

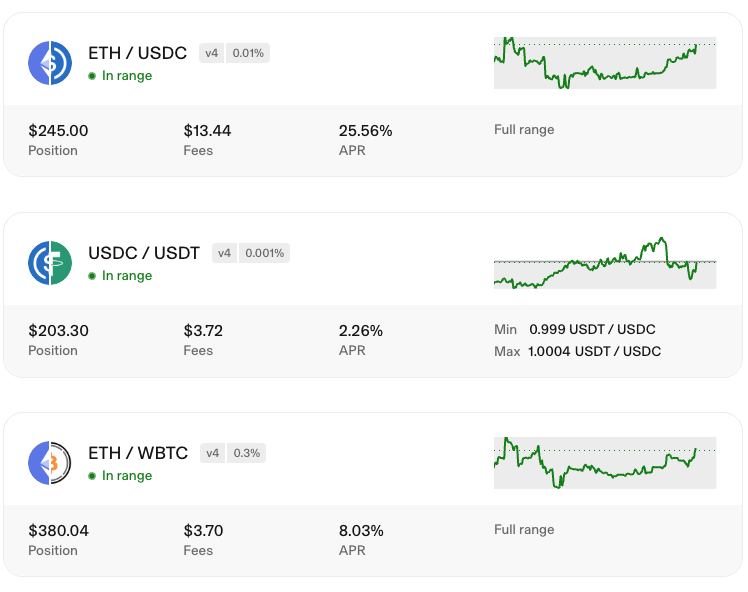

Two days ago, we published an analysis of three Uniswap v4 positions showing modest APRs-3.58% on ETH/USDC, 0.28% on USDC/USDT, and 1.21% on ETH/WBTC. Today, those same positions tell a completely different story: 25.56% APR, 2.26% APR, and 8.03% APR respectively.

This dramatic improvement isn't magic-it's what happens when you stay patient with liquidity provision on Ethereum.

The Numbers: Before and After

| Pair | Previous APR | Current APR | Improvement |

|---|---|---|---|

| ETH/USDC (0.01%) | 3.58% | 25.56% | 7.1x increase |

| USDC/USDT (0.001%) | 0.28% | 2.26% | 8.1x increase |

| ETH/WBTC (0.3%) | 1.21% | 8.03% | 6.6x increase |

Position Details (Current)

1. ETH / USDC (0.01% Fee Tier)

- Position Value: $245.00

- Fees Earned: $13.44

- APR: 25.56%

- Strategy: Full range

- Status: In range

2. USDC / USDT (0.001% Fee Tier)

- Position Value: $203.30

- Fees Earned: $3.72

- APR: 2.26%

- Strategy: Narrow range (0.999 - 1.0004 USDT/USDC)

- Status: In range

3. ETH / WBTC (0.3% Fee Tier)

- Position Value: $380.04

- Fees Earned: $3.70

- APR: 8.03%

- Strategy: Full range

- Status: In range

What Changed?

The positions themselves didn't change-we didn't rebalance, widen ranges, or move capital. What changed was market conditions and routing behavior.

Market Context

With ETH trading around $3,280 and BTC around $93,500, we're seeing strong trading volume flow through Uniswap v4 pools. This isn't just about price levels-it's about where traders are routing their swaps.

The Dynamic Routing Reality

Here's something important to understand: You have no control over which pools get selected as the "best price" by aggregators and routers. When you provide liquidity, you're essentially making a bet that:

- Your pool will be selected by routing algorithms

- Volume will flow through your specific fee tier

- Your price range will capture trades

In the first snapshot, volume was likely routing through v3 pools, Unichain, or other sidechains. Now, with current market conditions and ETH/BTC price levels, v4 pools are seeing more action. Learn more about how Uniswap v4 pools work and why routing matters.

The Patience Lesson

This update perfectly illustrates why patience is crucial when providing liquidity on Ethereum:

1. Volume is Volatile

Trading volume doesn't flow consistently. There are:

- Peak periods when aggregators route through your pools

- Quiet periods when volume goes elsewhere

- Market-driven spikes when volatility increases trading activity

2. Routing is Dynamic

Aggregators constantly evaluate:

- Which pools offer the best price

- Gas costs for different routes

- Liquidity depth across different versions (v3 vs v4)

- Cross-chain alternatives (Unichain, L2s)

You can't control this-you can only position yourself to capture volume when it comes your way.

3. Early Days Can Be Slow

Uniswap v4 is still relatively new. As adoption grows and more liquidity migrates to v4, routing algorithms increasingly favor v4 pools. The positions we opened early are now benefiting from this ecosystem maturation.

Why This Matters

Don't Chase Hot Pools

The temptation is to see low APRs and immediately move capital to "hotter" pools. But this update shows why that's often a mistake:

- Gas costs eat into returns when you're constantly moving positions

- You can't predict which pools will be hot next

- Patience pays off when market conditions shift in your favor

Full Range Still Works

All three positions are full-range (except the stablecoin pair, which uses a tight range by design). This proves that you don't need to constantly rebalance to capture good returns-especially when volume picks up.

Fee Tier Selection Matters

The 0.01% tier on ETH/USDC is now generating 25.56% APR-the highest of all three positions. This suggests that for high-volume pairs, lower fee tiers can actually outperform higher ones when volume is strong.

The Reality Check

While these APRs look great, remember:

- APRs are snapshots-they'll fluctuate as volume and routing change

- Historical returns tend to average around 5% over longer periods

- These are still early days for v4, and adoption is growing

But the key takeaway is clear: staying patient and letting positions mature can pay off dramatically when market conditions align.

What's Next?

We're not moving these positions. Why? Because:

- They're working-all three are generating solid returns

- Gas costs would eat into any gains from repositioning

- We can't predict if moving would improve returns

- Patience has already paid off-why change what's working?

As Uniswap v4 adoption continues to grow and more volume routes through v4 pools, we expect these positions to continue performing well. The lesson? Set it and forget it (with periodic monitoring) often beats constant repositioning.

Final Thoughts

This update demonstrates a fundamental truth about liquidity provision: patience is a strategy. When you provide liquidity, you're making a long-term bet on:

- Market conditions

- Routing behavior

- Protocol adoption

- Volume patterns

You can't control these factors, but you can position yourself to benefit when they align. The dramatic improvement in our APRs-from single digits to 8-25%-shows what's possible when you stay the course instead of chasing short-term gains.

The lesson: Slow and steady wins the liquidity race, and patience pays off on Ethereum. 🐢

Related Posts: