Uniswap v4: Early Observations on Impermanent Loss

Uniswap v4 has arrived, and while adoption is still in its early stages, it's already showing some intriguing behavior for liquidity providers-especially for those running wide-range positions.

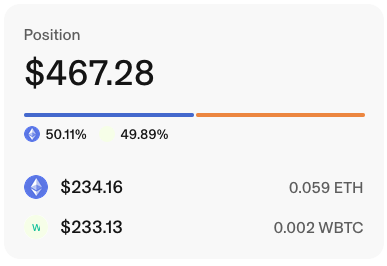

The screenshot above is from one of our live ETH/WBTC liquidity positions on Uniswap v4. What's striking here is how well the position has maintained its 50/50 asset split despite price volatility in both ETH and WBTC. Even as each token's price has fluctuated, the total value remains steady, with both sides hovering very close to the original deposit ratio.

Impermanent Loss - Reduced or Just Delayed?

In Uniswap v2 and v3, price divergence between paired assets often led to impermanent loss (IL) over time, especially in volatile pairs like ETH/WBTC. Wide-range positions in v3 could help reduce rebalancing frequency, but IL still accumulated as prices moved.

In this v4 position, however, we're seeing minimal divergence from our starting value-just normal wavering in token prices rather than a noticeable erosion in value. This could be due to a few factors:

- Wide-range setup: The position covers such a broad range that it's rarely forced to rebalance heavily, avoiding constant token swapping that contributes to IL.

- Market conditions: ETH and WBTC have been moving in a somewhat correlated manner recently, reducing directional risk.

- v4 mechanics: It's possible that changes in the underlying pool logic and fee handling in v4 slightly alter the rate at which divergence impacts value.

While it's too early to declare impermanent loss “solved,” the results so far are promising.

Fee Generation in Early v4 Pools

One thing to note: Uniswap v4 is still gaining traction. Many swap aggregators still prioritize routing through v2 and v3 pools, meaning v4 fee volume may be lower for now. As a result, yield hunters might see smaller returns until the wider DeFi ecosystem integrates v4 more fully.

Fee Generation in Early v4 Pools

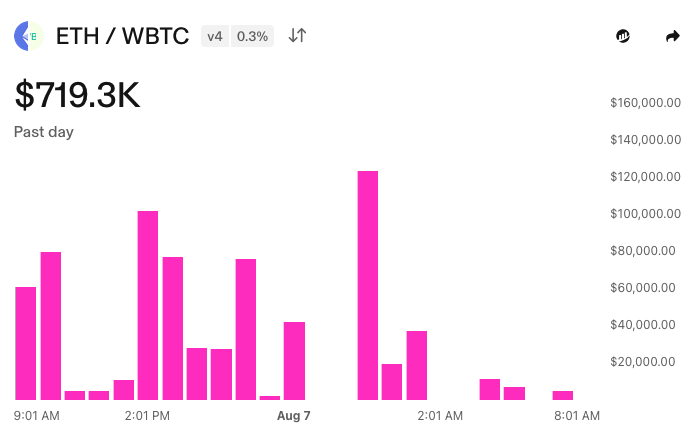

The chart above shows the past day of fee-generating volume for the ETH/WBTC Uniswap v4 pool at the 0.3% fee tier. While there are periods of strong activity, there are also entire hours with no swaps and zero fees earned.

This highlights one of the key trade-offs for LPs right now:

- While impermanent loss risk appears lower with wide ranges and correlated assets like ETH/WBTC,

- Fee revenue is still inconsistent compared to more established v2/v3 pools.

Many swap aggregators have not yet fully integrated v4 liquidity into their routing algorithms, meaning less trading activity flows through these pools. Until adoption grows, v4 LPs may see safer asset exposure but lower immediate returns. Over time, as aggregator support expands and liquidity deepens, we expect fee opportunities to improve.

Key Takeaways for LPs

- Wide ranges work well for pairs with correlated movements, reducing rebalancing and mitigating IL risk.

- Fee yield may be low initially while v4 adoption grows.

- v4's flexibility will likely unlock new LP strategies, but early positions may benefit most from correlated or stable pairs.

We'll continue to track this position and update as more data comes in. The next test will be to see how it performs in more volatile market swings-and whether the reduced IL trend holds over the long run.

Related Docs: Uniswap v4 Protocol Guide