Orca xORCA Staking: Attractive Yields When ORCA is Priced Right

Orca's xORCA staking offers a unique way to earn yield on your ORCA tokens by aligning your interests with the protocol's success. Unlike traditional staking that locks your tokens, xORCA is a liquid staking token that grows in value over time as the protocol buys back ORCA with trading fees.

Here's what makes xORCA staking attractive - and why buying ORCA at reasonable prices can significantly boost your effective yield.

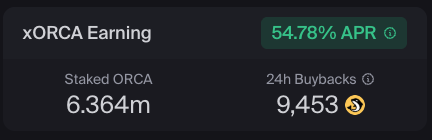

As of January 2026, xORCA staking is showing impressive yields exceeding 50% APR, with over 6.3 million ORCA staked and significant daily buybacks driving the exchange rate growth.

How xORCA Staking Works

xORCA is Orca's liquid staking mechanism, similar to liquid staking tokens (LSTs) like stETH or rETH. Here's the process:

- Stake ORCA → Receive xORCA tokens (tradable SPL tokens)

- Protocol buybacks → 20% of protocol fees (2.4% of total trading fees) are used to buy ORCA on the open market

- Vault growth → Purchased ORCA is deposited into the staking vault, increasing the ORCA/xORCA exchange rate

- Value appreciation → Each xORCA becomes redeemable for more ORCA over time, without you doing anything

Key Addresses:

- Staking Site: orca.so/stake

- xORCA Token:

xorcaYqbXUNz3474ubUMJAdu2xgPsew3rUCe5ughT3N(view on Solscan)

Why Entry Price Matters

The yield from xORCA staking comes from buybacks, not from token emissions. This means your effective yield depends heavily on when you buy ORCA:

The Buyback Math

The protocol uses a fixed percentage of trading fees (2.4% of total fees) to buy ORCA. Here's why price matters:

- If ORCA is $2.00: $19,200 in buybacks = 9,600 ORCA purchased

- If ORCA is $4.00: $19,200 in buybacks = 4,800 ORCA purchased

The same dollar amount buys half as many tokens when ORCA is expensive.

Example Scenario

Let's say Orca processes $1 billion in daily volume:

- Total fees: $800,000 (0.08% average fee)

- Protocol share: $96,000 (12% of fees)

- Buyback amount: $19,200 (20% of protocol share = 2.4% of total fees)

At different ORCA prices:

| ORCA Price | ORCA Purchased | Impact on Exchange Rate* |

|---|---|---|

| $1.50 | 12,800 ORCA | Higher (more tokens) |

| $2.00 | 9,600 ORCA | Medium |

| $3.00 | 6,400 ORCA | Lower (fewer tokens) |

| $4.00 | 4,800 ORCA | Much lower |

*Assuming 10,000,000 xORCA in circulation

The takeaway: Buying ORCA at lower prices means the same buyback dollars purchase more tokens, accelerating the exchange rate growth and boosting your effective yield.

Current Yield Potential

As of January 2026, xORCA staking is delivering exceptional yields exceeding 50% APR. The screenshot above shows real-time metrics:

- Current APR: >50% (54.78% as shown in the dashboard)

- Total Staked: Over 6.3 million ORCA

- 24h Buybacks: ~9,453 ORCA purchased daily from protocol fees

This impressive yield is driven by Orca's strong trading volumes (often exceeding $1 billion daily), which generate substantial protocol fees for buybacks. xORCA staking is most attractive when:

- Trading volume is high - More volume = more fees = more buybacks

- ORCA price is reasonable - Lower prices mean buybacks purchase more tokens

- You're a long-term holder - Exchange rate growth compounds over time

Important: Yields vary with trading volume and ORCA price. The >50% APR shown reflects current market conditions and may change. Past performance is not indicative of future returns. Always do your own research and consider the risks.

How to Stake ORCA

Step 1: Get ORCA Tokens

Purchase ORCA on Orca.so or other Solana DEXes. Consider the current price relative to historical levels - buying at reasonable prices improves your effective yield.

Step 2: Visit the Staking Page

Go to orca.so/stake and connect your Solana wallet.

Step 3: Stake Your ORCA

- Enter the amount of ORCA you want to stake

- Approve the transaction

- Receive xORCA tokens in your wallet

That's it! Your xORCA will automatically appreciate in value as buybacks occur.

Step 4: Monitor Your Position

You can:

- Track the exchange rate on the staking page

- Trade xORCA on DEXes (it's a standard SPL token)

- Use xORCA in DeFi - it's composable like any other token

Unstaking Process

If you want to unstake:

- Redeem xORCA → The program burns your xORCA and creates a Claim Ticket

- Wait 7 days → There's a cooldown period before you can withdraw

- Withdraw ORCA → Redeem your Claim Ticket for ORCA at the current exchange rate

Note: The exchange rate is snapshot at redemption time, so you'll receive ORCA based on the rate when you initiated the unstaking process.

Risks & Considerations

Smart Contract Risk

xORCA staking involves smart contracts. While Orca has undergone audits, there's always inherent risk. The protocol uses a 3-of-5 multisig for governance and upgrades.

Price Risk

ORCA price can fluctuate. If you buy at high prices and ORCA drops, you may experience capital loss even if the exchange rate increases.

Volume Risk

Yields depend on trading volume. If Orca's volume decreases, buybacks will be smaller, reducing the exchange rate growth.

Unstaking Cooldown

The 7-day cooldown means you can't immediately exit your position. Plan accordingly.

Market Conditions

During bear markets or low-volume periods, buybacks may be minimal, reducing yield potential.

Why This Matters for LPs

If you're providing liquidity on Orca (see our Orca Whirlpools guide), you're already earning fees from trading. Staking your ORCA rewards gives you additional yield on top of your LP earnings, creating a compound effect:

- Earn fees from providing liquidity

- Earn yield from staking ORCA rewards

- Benefit from buybacks that support ORCA price

This creates a flywheel effect where protocol success benefits both LPs and token holders.

The Bottom Line

xORCA staking offers an attractive way to earn yield on ORCA tokens, especially when:

- ORCA is priced reasonably - Lower entry prices mean buybacks purchase more tokens

- Trading volume is high - More volume = more fees = more buybacks

- You're a long-term holder - Exchange rate growth compounds over time

Key takeaway: The yield from xORCA staking comes from protocol buybacks, not token emissions. This means entry price matters - buying ORCA at reasonable prices can significantly improve your effective yield.

For more details on the mechanics, see the official xORCA documentation.

Related Guides:

- Orca Whirlpools Liquidity Provision Guide - Learn how to provide liquidity on Orca

- Solana Liquidity Providing Guide - Overview of LP opportunities on Solana