Uniswap v4 Returns: A Real-World Look at Three Active Positions

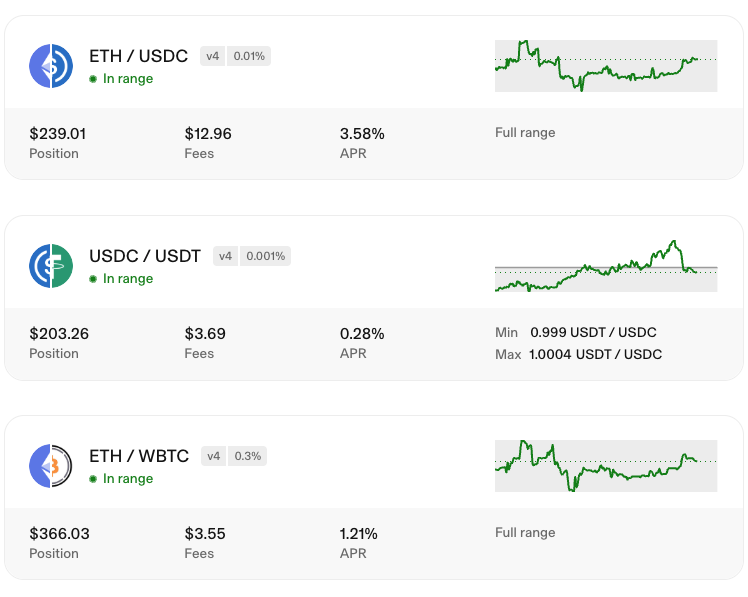

Uniswap v4 is live, and real liquidity providers are already putting it to the test. The screenshot above shows three active positions across different trading pairs, fee tiers, and strategies-giving us a real-world snapshot of how v4 performs in practice.

The Three Positions

1. ETH / USDC (0.01% Fee Tier)

- Position Value: $239.01

- Fees Earned: $12.96

- APR: 3.58%

- Strategy: Full range

- Status: In range

2. USDC / USDT (0.001% Fee Tier)

- Position Value: $203.26

- Fees Earned: $3.69

- APR: 0.28%

- Strategy: Narrow range (0.999 - 1.0004 USDT/USDC)

- Status: In range

3. ETH / WBTC (0.3% Fee Tier)

- Position Value: $366.03

- Fees Earned: $3.55

- APR: 1.21%

- Strategy: Full range

- Status: In range

Key Observations

Fee Tier Impact

The 0.01% fee tier (ETH/USDC) is generating the highest APR at 3.58%, despite having a smaller position size than ETH/WBTC. This suggests that:

- Volume matters more than fee percentage for smaller positions

- The 0.01% tier is attracting significant trading activity

- ETH/USDC is one of the most liquid pairs on Ethereum

Meanwhile, the 0.001% tier (USDC/USDT) shows the lowest APR at 0.28%. We picked a tight stablecoin range (0.999 - 1.0004) because a full-range position would earn practically zero fees due to the massive pool size. Even with this narrow range, the pair is consistently traded, and despite being out of range for a few days, we're still in good shape.

Full Range vs. Narrow Range

Both full-range positions (ETH/USDC and ETH/WBTC) are performing well, with the ETH/USDC position showing particularly strong fee generation. The narrow-range USDC/USDT position, while "in range," is earning minimal fees-highlighting the trade-off:

- Full range: Lower capital efficiency but more consistent fee generation

- Narrow range: Higher capital efficiency but requires active management and may miss fees if price moves out of range

Position Size vs. Returns

Interestingly, the smallest position (ETH/USDC at $239) has earned the most fees ($12.96), while the largest position (ETH/WBTC at $366) has earned the least ($3.55). This isn't necessarily a sign of poor performance-it could indicate:

- Different time horizons (positions may have been opened at different times)

- Varying market conditions during each position's lifetime

- Different fee accumulation periods

What This Means for LPs

For Volatile Pairs (ETH/USDC, ETH/WBTC)

- Full-range strategies are working well, especially for the 0.01% fee tier

- The 3.58% APR on ETH/USDC shows that even with lower fee percentages, high volume can drive solid returns

- Consider the 0.01% tier for major pairs where volume is high

For Stablecoin Pairs (USDC/USDT)

- Narrow ranges can work, but expect lower APRs

- The 0.001% fee tier is appropriate for stable pairs, but don't expect high yields

- These positions are better for capital preservation than aggressive yield generation

General Takeaways

- Volume is king: Higher trading volume can offset lower fee percentages

- Fee tier selection matters: Match your fee tier to the pair's volatility and expected volume

- Full range has its place: Don't underestimate full-range positions for volatile pairs

- All positions are in range: This suggests good position management or favorable market conditions

The Reality Check: Why These APRs Are Low (But That's OK)

Let's be honest: these displayed APR/APY values look modest. The ETH/USDC position shows 3.58% APR, ETH/WBTC is at 1.21%, and the stablecoin pair is just 0.28%. But here's the important context:

History has shown that trading activity typically pays us about 5% return over time. The displayed APRs are snapshots, and they don't tell the full story of what liquidity providers actually earn.

The Volume Challenge

One of the biggest realities of Uniswap v4 (and DeFi in general) is that volume isn't guaranteed. Several factors can impact fee generation:

- Cross-chain routing: Sometimes trading platforms route volume through Unichain or other sidechains instead of Ethereum mainnet. When that happens, we don't earn fees on those trades.

- v3 pool pricing: Sometimes v3 pools price better for traders, so aggregators route through v3 instead of v4. Again, no fees for us.

- Dead periods: There can be hours that go by without any fees earned. This is normal, especially in early v4 adoption when liquidity is still migrating.

Why We're Still Ahead

Despite these challenges, we're overall ahead. The positions are generating fees consistently, and even when we were out of range on the stablecoin pair for a few days, we're still in good shape.

More importantly, we'd probably lose more in fees searching for "hot" pools than we earn by staying put. Gas costs add up quickly when you're constantly moving positions around chasing higher yields.

The v4 Advantage

What's notable here is that all three positions are showing positive returns with fees accumulating steadily. While it's still early days for Uniswap v4, these results suggest that:

- v4's improved capital efficiency is working as intended

- Fee generation is consistent across different strategies (even if not always visible in real-time)

- The platform is handling multiple positions smoothly

Final Thoughts

These three positions represent a diverse portfolio of LP strategies-from high-volume volatile pairs to low-volatility stablecoin arbitrage. The fact that all are generating fees and staying in range demonstrates that Uniswap v4 offers flexibility for different risk profiles and yield targets.

For LPs considering v4, this data suggests:

- Start with full-range positions on major pairs to minimize management overhead

- Consider the 0.01% fee tier for high-volume pairs like ETH/USDC

- For stablecoin pairs, use tight ranges to maximize capital efficiency-full range earns practically nothing in large pools

- Don't chase "hot" pools-gas costs will eat your profits

- Be patient with low APRs-they're snapshots, not the full picture

As v4 adoption grows and more liquidity flows through these pools, we expect to see even more compelling returns. The foundation is solid-now it's about finding the right strategy for your risk tolerance and yield goals.

Remember: slow and steady wins the liquidity race! 🐢

Related Docs: Uniswap Protocol Guide