$2,000 to $22 Million? This Liquidity Pool Could Do It

"It's not magic. It's math." - LiquidityGuide.com

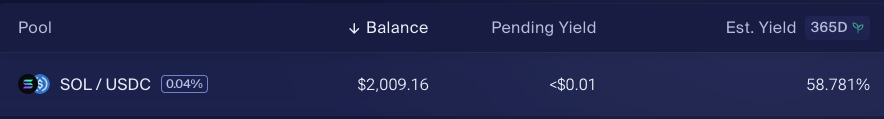

Here's what happens when you put $2,009.16 into a liquidity pool that's earning 58.781% APY, and just leave it there.

No trading. No taxes. No claims. Just pure compounding.

The Math

Let's assume the APY stays constant (it won't - but let's dream), and you auto-compound the fees back into the pool. Here's how the balance grows:

Formula:

We're using continuous compounding:

A = P x e^{rt}

Where:

P= Initial principal = $2,009.16r= Annual interest rate = 0.58781t= Time in years = 20e≈ 2.71828

Result:

A = $2,009.16 × e^(0.58781 × 20)

A ≈ $2,009.16 × 11,197.53

A ≈ $22,483,228.36

Yes, $22.48 million - if the rate holds and everything compounds continuously.

Reality Check 🧠

This is not a guarantee. Rates like 58% are extremely volatile. Risks include:

- Impermanent loss (IL)

- Pool APY dropping over time

- Price of SOL crashing or soaring

- Smart contract risk

- Regulatory or DeFi platform risks

But the point isn't to promise you millions - it's to show you what's possible with:

- High APYs

- Long time horizons

- The magic of compounding

TL;DR

Put $2,000 in a liquidity pool at 58.781% APY, walk away for 20 years, and you could come back to $22 million.

The question is:

Do you believe in your pool that much?

👉 Got a better pool or strategy?