🚀 The Ultimate Uniswap V4 Liquidity Provision Guide

Uniswap V4 refines decentralized trading with next-gen concentrated liquidity and deep customization. It builds on V3's focus on capital efficiency but adds new dimensions-Hooks, gas optimizations, dynamic fee control, and native ETH support-to help LPs earn more while managing risk.

This guide walks you through everything you need: setup, strategies, tools, and advanced tactics to confidently provide liquidity and capture yield.

🧱 1. Understanding Concentrated Liquidity

Like V3, Uniswap V4 lets you allocate liquidity within a custom price interval on a 50/50 constant-product AMM curve. This enhances capital efficiency and concentrates fee earnings where trading action happens-while requiring active range management when prices move outside your chosen ticks.

💰 What's New in Uniswap V4

• Hooks & Custom Pool Logic

Uniswap V4 introduces Hooks-modular smart-contract callbacks that trigger before/after key events like swaps and liquidity updates. This enables powerful customizations: on-chain limit orders, dynamic fees, rebasing, oracle integration, or even MEV protection-all natively in the AMM.

Common V4 Hook Examples:

- Limit Orders: Execute trades automatically when price reaches a target

- Dynamic Fees: Adjust fees based on volatility or market conditions

- TWAP Oracles: Provide time-weighted average prices for other protocols

- Geomean Oracles: Alternative pricing mechanism for specific use cases

- Auto-Compounding: Automatically reinvest fees back into the pool

For developers, see the Uniswap V4 Hooks documentation and explore example hooks implementations on GitHub.

• Singleton Architecture

All pools now live under a single PoolManager contract, eliminating per-pool deployments. This design significantly reduces gas for pool creation and enables multi-hop swaps without extra token transfers.

• Flash Accounting

Flash accounting uses transient storage to batch balance updates within a single transaction, settling net token deltas at the end. This reduces gas costs dramatically for multi-step operations.

• Native ETH Support

No more WETH wrap/unwrap: Uniswap V4 supports native ETH trading, making liquidity provision and swapping simpler-while saving you gas.

• Dynamic & Unlimited Fee Tiers

Rather than fixed fee tiers (like 0.05%, 0.3%, 1%), V4 allows dynamic and customizable fee structures, defined in Hooks and adjustable per transaction or market condition.

Why This Matters for LPs

| Feature | Benefit |

|---|---|

| Concentrated Liquidity | Higher fee capture with less idle capital |

| Hooks | Enables auto-compounders, limit orders, oracles & custom logic |

| Singleton & Flash Accounting | Cheaper transactions and multi-hop trades |

| Native ETH | Smoother user experience + lower gas costs |

| Dynamic Fees | Tailored fee structures per pool or market condition |

Uniswap V4 combines the best of V3 with more control, efficiency, and developer innovation, giving LPs serious new tools to compete and capture yield. Uniswap V4 is a game-changer for liquidity providers, offering advanced features that allow for greater customization and efficiency in managing liquidity positions. Whether you're a seasoned LP or just starting out, understanding these new capabilities is crucial to maximizing your returns and minimizing risks.

🛠 2. How to Add Liquidity

Providing liquidity on Uniswap V4 is a bit more involved than past versions, but it opens the door to powerful customization. LPs must now decide where to concentrate their liquidity, how wide their price range should be, and which fee tier best matches expected volatility. Here's a step-by-step guide to getting started:

- Connect your wallet and open a New Position on Uniswap V4.

- Select your token pair (e.g., ETH/USDC) and choose a fee tier (0.01%, 0.05%, 0.3%, or 1%) based on expected volatility.

- Define a price range-wide range = passive income, narrow range = high fees.

- Deposit both tokens, approve the contract, and mint your NFT LP position.

- Collect trading fees at any time without closing the position.

📈 3. Strategy Playbook

Different market conditions call for different liquidity strategies. Whether you're looking to "set it and forget it" or actively chase trading volume and fees, your approach to defining price ranges will shape your returns - and your risk exposure. Here are three core strategies used by LPs today:

Passive (Wide Range)

- Example: ETH/USDC at $2,500-$4,000 (2025-2026 price range)

- Low maintenance, steady fee stream

- Ideal for LPs seeking long-term returns

- Works well when ETH is trading around $3,000-$3,500 (current 2026 levels)

Active (Narrow Range)

- Example: ETH/USDC at $3,000-$3,500

- High fee potential-yields can reach 20-25%+ APR in peak conditions

- Requires frequent rebalance to remain in range

- Best for LPs who can monitor positions daily

Hedged Strategy

🧰 4. Tools & Resources

Managing a concentrated liquidity position is much easier when you have access to the right data and automation tools. Whether you want to backtest a strategy, monitor real-time fees, or develop custom bots, these resources can help you LP smarter and stay ahead of market shifts.

- Uniswap Docs & Interface - guides fee tiers, ticks, and LP basics

- Chaos Labs Backtester - simulate Uniswap strategies for price, fees, and rebalance timing

- Gamma Strategies - track Uniswap V3 performance and analytics (Note: APY.vision is currently offline - see our blog post for alternatives)

- DefiLlama - comprehensive DeFi analytics and pool tracking

- Uni SDK - build or automate LP strategies and collect position metadata

- Uniswap Explore - sort pools by "1D vol/TVL" to find the highest-paying pools - this metric highlights pools with the best trading volume relative to TVL

⚠️ 5. Risk Management

With increased flexibility comes increased risk. While Uniswap V4 lets you earn more from trading fees, it also exposes you to impermanent loss, gas costs from rebalancing, and a higher need for active monitoring. Smart LPs consider these risks before going live with capital.

- Impermanent Loss: Narrow ranges magnify IL if price diverges. Passive LP mitigates risk. Use our built-in IL calculator to estimate your risk before opening a position.

- Rebalance Costs: Gas fees on Ethereum can erode returns-especially if rebalancing often.

- Complexity: Managing price ranges makes V4 more advanced; knowledgeable LPs tend to benefit most.

- Routing Risk: Volume may route through v3 pools, Unichain, or other sidechains instead of your v4 pool. You have no control over which pools aggregators select.

For a comprehensive guide to all DeFi risks, see our Risks of Providing Liquidity page.

6. Example Scenario: ETH/USDC (2025-2026)

Let's put theory into practice. Below is a simplified example of how a liquidity provider might approach ETH/USDC with current market conditions. With ETH trading around $3,000-$3,500 in 2026, here's how different strategies perform:

Narrow Range Strategy

- Strategy: Narrow range - $3,000-$3,500

- Fees earned: Varies significantly based on routing and volume

- APR estimate: Can reach 20-25%+ during peak periods (see our real-world analysis)

- Action plan: Monitor daily, rebalance weekly, consider hedging with a short position

Wide Range Strategy

- Strategy: Wide range - $2,500-$4,000

- Fees earned: More consistent but lower per dollar

- APR estimate: 5-10% typically, but more stable

- Action plan: Monitor monthly, minimal rebalancing needed

Real-world data: Our Uniswap v4 returns analysis shows ETH/USDC positions generating 3.58% to 25.56% APR depending on market conditions and routing behavior. The key lesson: patience pays off - APRs fluctuate dramatically as volume routes through different pools.

🧩 7. Advanced Concepts

Once you're comfortable with the basics, you can begin exploring automation, optimizing for fee tiers, and even hedging positions programmatically. These concepts aren't essential for first-timers, but can dramatically improve outcomes for long-term, high-volume LPs.

- Dynamic Rebalancing Agents using SDK or third-party bots

- Fee Tier Optimization: Adjust tiers (e.g. 0.05%-1%) based on expected market action

- On-chain Hedging: Build a delta-neutral position via options or perpetuals

Calculators & Tools

Calculating potential returns, impermanent loss, and optimal price ranges is essential for successful Uniswap V4 liquidity provision. We've compiled a comprehensive guide to all the best calculators and tools available.

👉 See our complete Liquidity Provision Calculators & Tools guide

This guide includes:

- Impermanent Loss Calculators - Understand IL risk for both standard and concentrated liquidity positions

- Uniswap-Specific Tools - Fee estimators, APR calculators, and range optimizers for V3 and V4

- Best Practices - How to use calculators effectively and avoid common pitfalls

- Strategy Integration - How to incorporate calculators into your LP strategy

We also provide built-in calculators on our Impermanent Loss page for quick IL calculations without leaving the site.

🎯 Bonus: Where You Can LP with Uniswap V4

Uniswap isn't limited to Ethereum mainnet anymore-it's gone truly multichain, offering liquidity provision across a growing number of EVM-compatible chains. Here's where you can add LP capital using Uniswap V4:

- Ethereum Mainnet - The original home of Uniswap and still the largest by TVL and volume

- Layer 2 Networks:

- EVM-Compatible L1 Chains:

- Avalanche - Fast, low-cost L1 with active DeFi

- BNB Smart Chain - Binance's EVM-compatible chain

- Celo - Mobile-first blockchain with DeFi integrations

- Other EVM Rollups & Sidechains:

- Polygon - Popular sidechain with extensive DeFi ecosystem

- Unichain - Uniswap's dedicated Layer 2 chain optimized for DEX trading with ultra-low fees

- WorldChain - Emerging L2 focused on global accessibility

- zkSync - Zero-knowledge rollup with growing adoption

Important Note on Unichain: Unichain is Uniswap's dedicated Layer 2 blockchain designed specifically for decentralized exchange activity. While it offers extremely low fees, volume routing through Unichain means you won't earn fees on Ethereum mainnet pools. This is a key consideration when choosing where to provide liquidity - see our returns analysis for how routing affects your earnings.

Many of these support Uniswap V2, V4, and even V4 deployments

💡 Finding the Best Chains: Before committing capital, check DefiLlama to compare TVL (Total Value Locked) and trading volume across different chains. Chains with higher TVL and volume typically offer better fee opportunities, but may also have more competition. Use DefiLlama's chain comparison tools to find the right balance for your strategy.

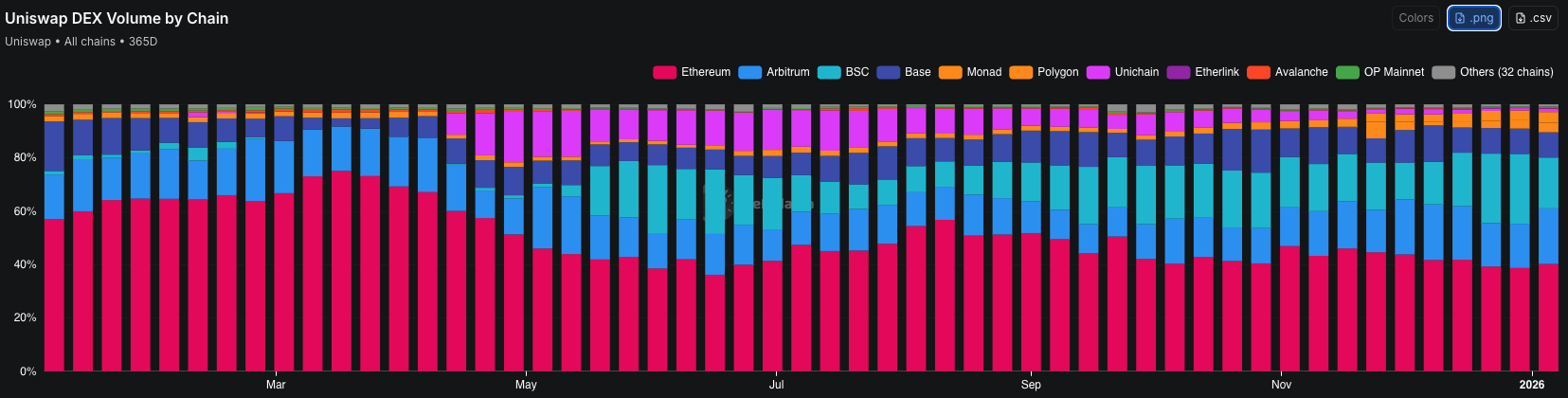

📊 Uniswap Volume Distribution by Chain

Understanding where Uniswap volume is actually flowing helps you make informed decisions about where to provide liquidity. The chart below shows the 365-day volume distribution across all chains where Uniswap operates:

Key Insights:

- Ethereum maintains the largest share (40-70% of total volume), making it the most reliable for consistent fee earnings

- Arbitrum is the second-largest contributor (15-30%), offering lower fees with strong volume

- Base has shown significant growth, particularly from mid-2025 onwards

- Unichain experienced notable volume increases during 2025, demonstrating the impact of routing through Uniswap's dedicated L2

- BSC, Polygon, and other chains contribute smaller but meaningful percentages

💡 Pro Tip: For the most up-to-date volume data and chain comparisons, check the DefiLlama Uniswap Volume Report. This interactive dashboard lets you filter by time period, compare chains, and identify emerging opportunities.

🧠 Why This Matters for LPs

- Lower Fees, Faster TX: Moving LP activity off Ethereum mainnet to L2s like Arbitrum, Optimism, and Base dramatically reduces gas costs while maintaining Uniswap's advanced V4 features.

- Emerging Chains = New Opportunities: Chains like Avalanche, BNB, Polygon, and Celo may have lower competition, so you can front-run major TVL while earning competitive yields.

- Protocol Alignment: Uniswap Labs tests and supports major deployments-use this to access reliable, audited V4 pools with strong community backing.

🙌 Summary

Uniswap V4 empowers you to:

- Achieve higher fee yields by concentrating liquidity

- Choose between passive and active strategies

- Access powerful tools and backtesting frameworks

- Manage risks like impermanent loss and gas costs

📍 Next steps:

- Try Uniswap's beginner-friendly wide-range LP

- Use backtester to simulate narrow-range returns before committing capital

- Explore hedging with GMX or similar tools for delta-neutral LP

- Sort pools by "1D vol/TVL" on Uniswap Explore to find the highest-paying pools

- Check our real-world returns analysis to see how v4 performs in practice

📚 Related Blog Posts

- Uniswap v4 Returns: A Real-World Look at Three Active Positions - See actual APRs and strategies from live positions

- Uniswap v4 Returns Update: Patience Pays Off - How APRs improved from 3.58% to 25.56% by staying patient

- APY.vision Goes Offline - What It Means for LP Analytics - Alternative tools now that APY.vision is down

- Uniswap v4: Early Observations on Impermanent Loss - How v4 handles IL differently

📊 Most Active Pools (2025-2026)

Based on trading volume and TVL, the most active Uniswap pools for liquidity provision are:

- ETH/USDC - Highest volume pair, best for 0.01% fee tier

- ETH/WBTC - Strong volume, works well with 0.3% fee tier

- USDC/USDT - Stablecoin pair, use 0.001% fee tier with tight ranges

Pro Tip: Use Uniswap Explore and sort by "1D vol/TVL" to identify pools with the highest trading activity relative to their size. This metric highlights pools that generate the most fees per dollar of liquidity, making it easier to find the best opportunities.