Wide-to-Narrow Strategy: Orca Fees → Meteora High Volume

The Wide-to-Narrow Strategy is an advanced liquidity provision approach that combines the best of both worlds: passive wide-range positions on Orca (no rent costs) with active narrow-range positions on Meteora (higher volume, dynamic fees). This strategy builds on the LP Flywheel by systematically redeploying fees from low-maintenance positions into high-yield opportunities.

🎯 The Core Concept

The Problem:

- Orca: Great for wide ranges ($120-$280 for SOL/USDC) with no rent costs, but volume can be lower

- Meteora: Higher volume and dynamic fees, but wide ranges cost significant SOL in rent - making passive wide positions impractical

The Solution:

- Start Wide on Orca: Open a wide-range position (e.g., SOL/USDC $130-$280) that requires minimal maintenance

- Earn Fees: Let the position accumulate fees over weeks/months

- Harvest & Deploy Narrow on Meteora: Use accumulated fees to open narrow, high-volume positions on Meteora where rent costs are manageable

This strategy leverages each protocol's strengths while avoiding their weaknesses.

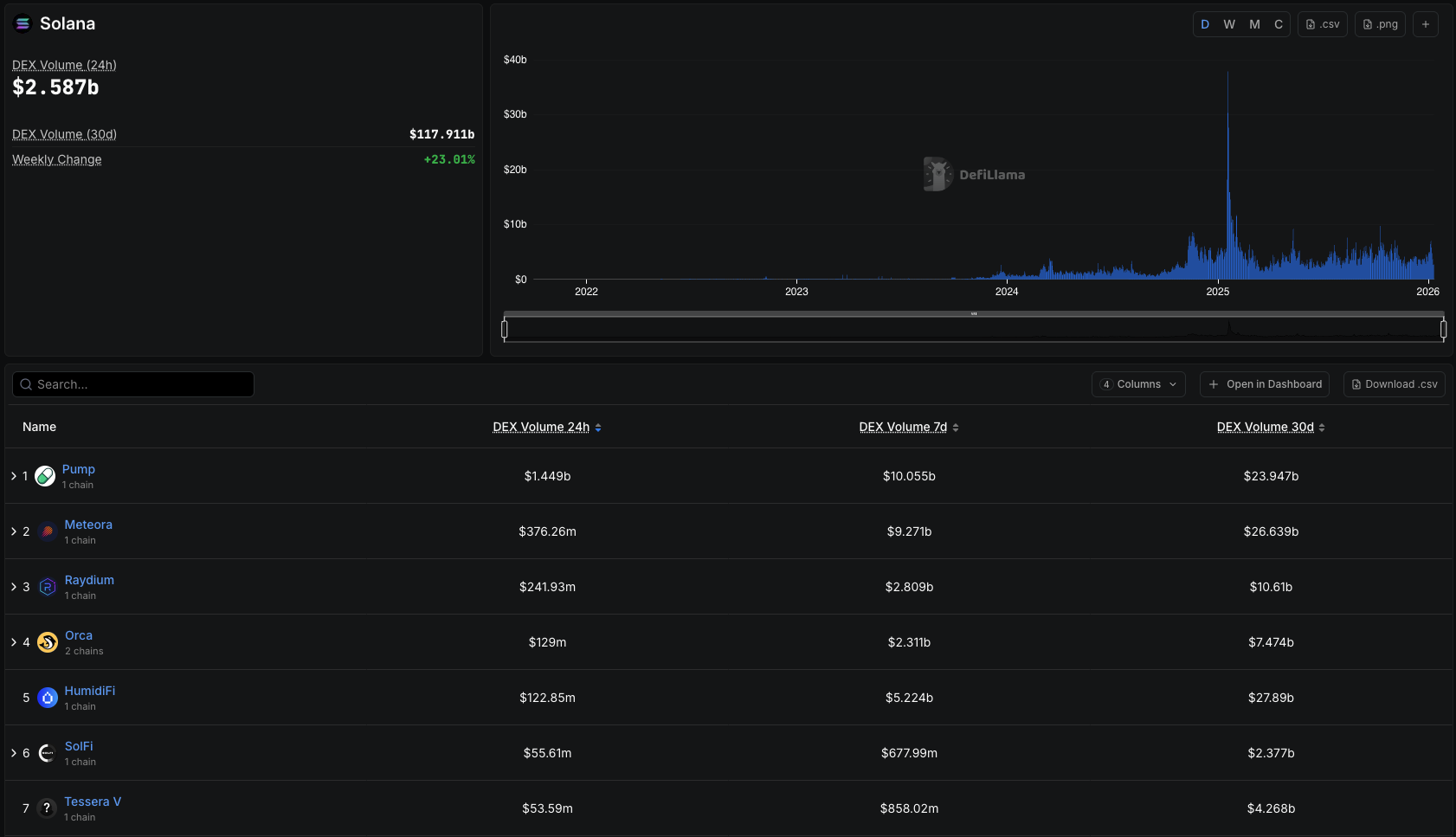

📊 Why This Works: Volume Comparison

As shown in the Solana DEX volume data, Meteora consistently processes significantly more volume than Orca:

- Meteora: $376M+ in 24h volume, $9.2B+ in 7-day volume

- Orca: $129M in 24h volume, $2.3B in 7-day volume

Higher volume = more trading fees for LPs. However, Meteora's rent structure makes wide positions expensive, while Orca allows wide positions with no additional rent beyond initial setup.

🏗️ How It Works: Step-by-Step

Phase 1: Build Your Base on Orca

Goal: Establish a passive income stream with minimal rent costs

-

Choose a Wide Range: For SOL/USDC, a range like $130-$280 works well for passive strategies

- This range covers most of SOL's typical trading range over 1+ years

- See our Orca guide for range selection tips

- See our optimal SOL/USDC range analysis for detailed price history

-

Deposit Liquidity: Add SOL and USDC to your Orca Whirlpool position

- Orca charges minimal rent (~0.07-0.14 SOL for first-time tick arrays, refundable)

- No ongoing rent costs for range width

-

Let It Run: Monitor occasionally, but don't stress about daily rebalancing

- Wide ranges reduce the risk of going out of range

- Fees accumulate automatically in your position

Expected Yield: ~20-25% APR on average for wide SOL/USDC ranges (varies with market conditions)

Phase 2: Harvest Fees and Deploy on Meteora

Goal: Convert accumulated fees into high-volume, narrow positions

-

Claim Fees from Orca: Withdraw accumulated fees from your Orca position

- Fees are automatically added to your position value

- You can withdraw fees by partially withdrawing liquidity

-

Choose Narrow Range on Meteora: Select a tight range around current price

- Example: If SOL is at $150, choose $145-$155 (narrow range)

- Narrow ranges on Meteora have manageable rent costs (unlike wide ranges)

- See our Meteora guide for detailed setup instructions

-

Understand Bin Step: This is critical for Meteora strategy

- Bin Step = The price difference between consecutive bins (price points)

- Smaller bin step = More bins per dollar = More volume capture, but smaller max range

- Larger bin step = Fewer bins per dollar = Less volume, but wider max range possible

- For narrow ranges, you can use smaller bin steps to maximize fee capture

- See Meteora's bin step documentation for details

-

Deposit on Meteora: Use your harvested fees to open the narrow position

- Rent costs for narrow ranges are reasonable (typically 0.1-0.5 SOL)

- Dynamic fees mean you earn more during volatile periods

Expected Yield: 30-100%+ APR on narrow ranges during high-volume periods (varies significantly with volatility and volume)

🔧 Understanding Bin Step on Meteora

Bin Step is a fundamental concept for Meteora DLMM that directly impacts your strategy:

What is Bin Step?

Each bin represents a single price point, and bin step is the difference between two consecutive bins. Bin steps are calculated based on basis points set by the pool creator.

Example: If SOL/USDC is $150 and bin step is 25 basis points (0.25%):

- Bin 1: $150.00

- Bin 2: $150.00 × 1.0025 = $150.38

- Bin 3: $150.38 × 1.0025 = $150.75

- And so on...

How Bin Step Affects Your Strategy

| Bin Step Size | Volume Capture | Max Range | Best For |

|---|---|---|---|

| Smaller (e.g., 1-10 bps) | Higher (more continuous price range) | Smaller (limited bins per position) | Narrow ranges, stable pairs |

| Larger (e.g., 25-100+ bps) | Lower (less continuous) | Larger (more bins per position) | Wide ranges, volatile pairs |

For the Wide-to-Narrow Strategy:

- On Orca (Phase 1): You don't need to worry about bin steps - Orca uses ticks, not bins

- On Meteora (Phase 2): Choose pools with smaller bin steps for narrow ranges

- Smaller bin steps = more bins in your narrow range = better volume capture

- Since you're using narrow ranges anyway, you can maximize volume with smaller bin steps

- The max # of bins per position is 1,400, so with smaller bin steps, you can still cover a meaningful price range

Key Insight: For narrow, high-volume positions, smaller bin steps are your friend. They allow you to capture more trading volume while keeping rent costs reasonable (since you're using a narrow range).

💰 Real-World Example

Scenario: You have $10,000 to deploy

Month 1-3: Build Base on Orca

- Deposit: $10,000 in SOL/USDC on Orca

- Range: $130-$280 (wide, passive)

- Rent Cost: ~0.1 SOL (one-time, mostly refundable)

- Fees Earned: ~$500-625 over 3 months (assuming 20-25% APR)

- Maintenance: Minimal - check monthly

Month 4: Harvest & Deploy on Meteora

- Harvest: $500 in fees from Orca position

- Deploy on Meteora: $500 in narrow SOL/USDC position

- Range: $145-$155 (narrow, around current price of $150)

- Bin Step: Choose pool with smaller bin step (e.g., 5-10 bps) for better volume capture

- Rent Cost: ~0.2 SOL (reasonable for narrow range)

- Expected Yield: 40-80% APR during high-volume periods

Ongoing Strategy

- Orca Position: Continues earning ~20-25% APR passively

- Meteora Position: Requires more monitoring (narrow range), but earns higher yields

- Reinvest: As Meteora position earns fees, you can:

- Add to existing Meteora position

- Open additional narrow positions

- Reinvest back into Orca for more passive income

- Take profits

⚖️ Trade-offs & Considerations

Advantages

Best of Both Worlds: Passive income from Orca + high yields from Meteora

Capital Efficiency: Wide Orca position doesn't tie up capital for rent

Volume Capture: Meteora's higher volume means more fees

Dynamic Fees: Meteora's dynamic fee system rewards volatility

Flexibility: Can adjust strategy based on market conditions

Disadvantages

❌ Active Management: Meteora narrow positions require monitoring

❌ Rent Costs: Even narrow Meteora positions cost SOL in rent

❌ Out-of-Range Risk: Narrow positions can go out of range quickly

❌ Complexity: Managing positions on two protocols adds complexity

❌ Gas Costs: More transactions = more SOL spent (though minimal on Solana)

When to Use This Strategy

Good for:

- LPs who want passive income but are willing to actively manage high-yield positions

- Those comfortable with Solana's low fees enabling frequent rebalancing

- LPs who understand both Orca and Meteora mechanics

- Strategies where you want to compound fees into higher-yield opportunities

Not ideal for:

- Completely passive LPs who don't want to monitor positions

- Those uncomfortable with managing multiple protocols

- Very small capital amounts (rent costs become proportionally larger)

- LPs who prefer simplicity over optimization

🔗 Related Resources

- LP Flywheel Strategy: The foundational strategy this builds upon

- Orca Whirlpools Guide: Complete guide to Orca's concentrated liquidity

- Meteora DLMM Guide: Detailed Meteora setup and strategies

- Optimal SOL/USDC Range Analysis: Price history and range selection for SOL/USDC

- Orca Billion Dollar Volume Post: Context on Orca's volume and growth

- Meteora Bin Step Documentation: Official Meteora docs on bin steps

📝 Summary

The Wide-to-Narrow Strategy is a sophisticated approach that:

- Starts with passive wide positions on Orca - No rent costs, minimal maintenance, steady income

- Harvests fees systematically - Builds a capital base from passive income

- Deploys narrow positions on Meteora - Captures high volume with dynamic fees, manageable rent costs

- Leverages bin step selection - Uses smaller bin steps for narrow ranges to maximize volume capture

This strategy requires active management of Meteora positions but rewards you with higher yields while maintaining a passive income stream from Orca. It's perfect for LPs who want to optimize their capital efficiency across Solana's top DEXes.

Remember: Always do your own research, understand the risks (impermanent loss, smart contract risk, out-of-range positions), and start with smaller positions to learn the mechanics before scaling up.